Artificial Intelligence has transformed global finance, from high-frequency trading to advanced risk modeling. Yet one challenge remains: creating strategies that consistently outperform in real markets, not just in backtests.

A new study led by Paulo André Lima de Castro introduces AlphaX, an AI-powered value investing system designed specifically for the Brazilian stock market. Unlike traditional algorithmic strategies that often collapse under live trading conditions, AlphaX integrates deep learning, reinforcement learning, and bias controls to deliver robust performance across market cycles.

Why Traditional AI Trading Falls Short

Many AI models show strong returns in backtesting but underperform in real-world scenarios due to:

- Lookahead Bias – Using future information during training that isn’t available in live markets.

- Overfitting – Models tuned too closely to past data fail when conditions change.

- Volatility Risks – AI struggles to adjust to emerging shocks and unique local market behaviors.

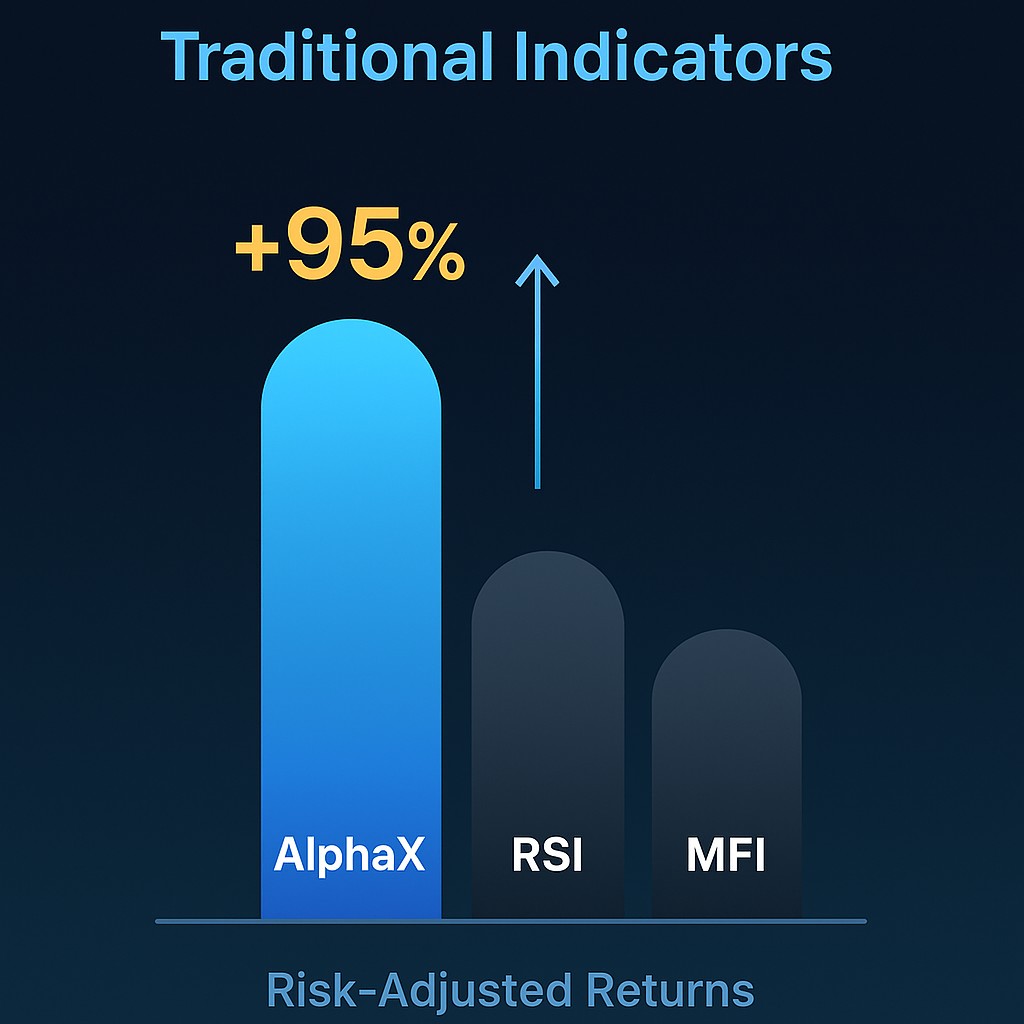

As a result, while technical indicators such as Relative Strength Index (RSI) or Money Flow Index (MFI) remain popular, they often lack consistency in volatile emerging markets like Brazil.

What Makes AlphaX Different?

AlphaX adapts the principles of classic value investing—made famous by Warren Buffett—into an AI framework.

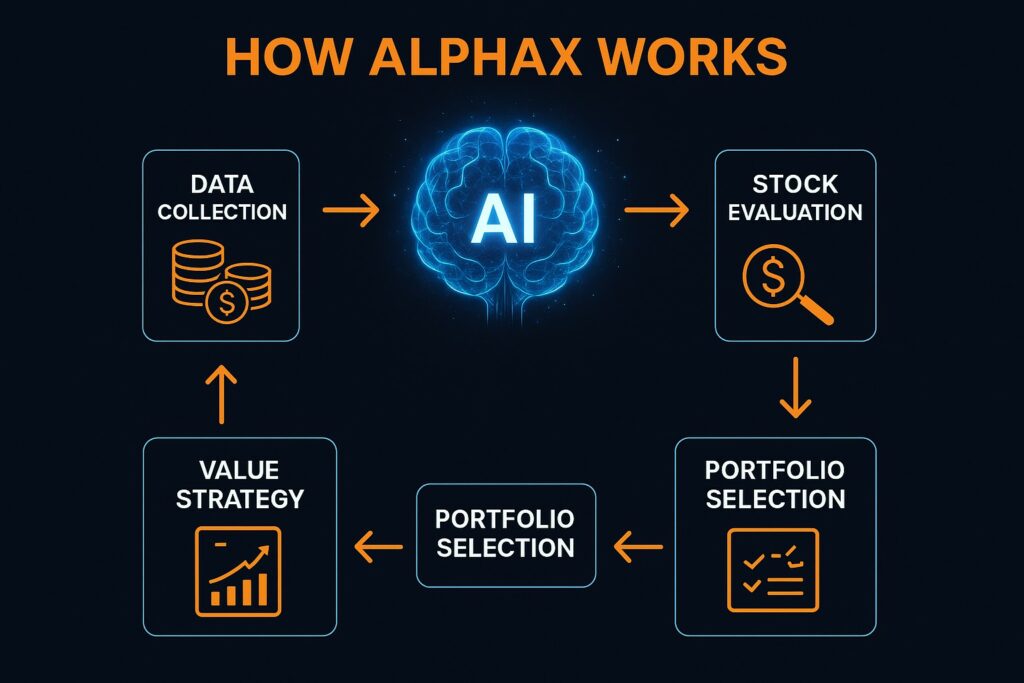

Key innovations include:

- Bias Control: Simulation environments designed to minimize lookahead and overfitting errors.

- Deep Reinforcement Learning: Agents that “learn by doing,” refining strategies with feedback loops.

- Fundamental Analysis Integration: Beyond price signals, AlphaX incorporates fundamental data for long-term value detection.

- Brazil-Focused Dataset: Trained specifically on Brazilian equities to capture unique market patterns.

Results: Outperforming Benchmarks

The study compared AlphaX against:

- Major Brazilian market benchmarks

- Popular indicators like RSI and MFI

Findings showed:

- Consistent Outperformance: AlphaX beat benchmarks with statistical significance.

- Superior Risk-Adjusted Returns: Delivered more stable profits with lower volatility.

- Scalability: Effective across multiple stocks and timeframes.

Open Challenges & Future Potential

Despite its success, AlphaX highlights several ongoing challenges in AI-based investing:

- Interpretability: Explaining AI’s decisions remains difficult for investors and regulators.

- Qualitative Analysis: Incorporating sentiment, governance, and ESG data is still limited.

- Global Expansion: While AlphaX thrives in Brazil, adapting it to global markets may require retraining on local data.

Emerging technologies like natural language processing for earnings calls and hybrid AI-human decision systems could enhance AlphaX into a more comprehensive AI-based value investing framework in the future.

Why This Matters for Investors

- For Institutions: Provides a scalable, statistically reliable alternative to traditional indicators.

- For Retail Investors: Demonstrates the next wave of AI tools moving beyond speculation into fundamentally-driven strategies.

- For Markets: Signals a broader shift toward AI that can interpret fundamentals, not just technical patterns.