Artificial intelligence could add as much as $16 trillion in value to the US stock market, according to a new forecast from Morgan Stanley strategists.

AI as a Market Catalyst

The bank estimates that S&P 500 companies could see between $13 trillion and $16 trillion in gains as AI technologies fuel productivity, cut costs, and unlock new revenue streams. At the high end, this would represent a 29% increase in the index’s market cap.

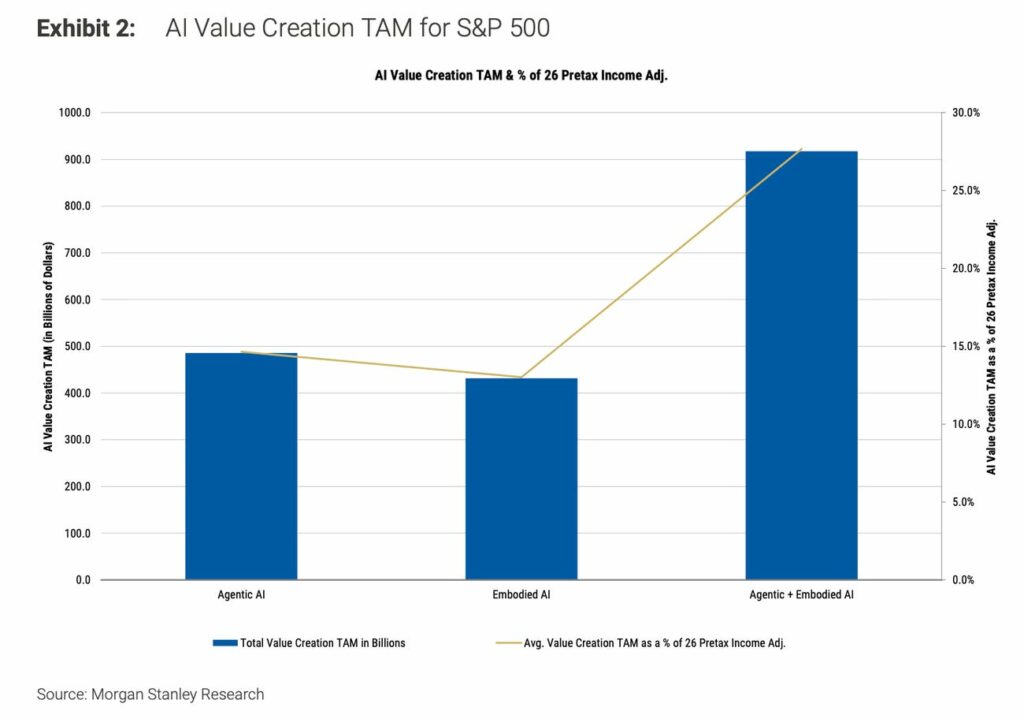

Key drivers of this growth include:

- Agentic AI (decision-making AI with less supervision): ~$490 billion in added value.

- Embodied AI (humanoid robots): ~$430 billion in added value.

Together, these innovations could boost S&P 500 adjusted pre-tax income by more than 25%, the report noted.

Sector Winners

Morgan Stanley highlighted that the biggest AI-driven gains could be realized in:

- Consumer staples & retail distribution

- Real estate

- Transportation

In some cases, long-term value creation could more than double expected 2026 pre-tax income in these sectors.

The Job Market Impact

While investors may celebrate, workers could face disruption. Morgan Stanley warned that up to 90% of existing jobs may be affected by AI adoption. Many employees may need to reskill or switch careers, but new roles could emerge, including:

- AI supply chain analysts

- AI ethicists

The bank stressed that, historically, new technologies created net jobs over time — but warned of potential short-term displacement.

Competing Forecasts

Other analysts have expressed more caution:

- Goldman Sachs (2023): AI could automate 300 million jobs worldwide, particularly in admin and legal roles.

- Anthropic CEO Dario Amodei: AI might wipe out half of entry-level white-collar jobs within five years, potentially pushing US unemployment to 20%.

Long-Term Outlook

Morgan Stanley emphasized that its $16 trillion projection assumes widespread adoption of AI over several years. As AI capabilities improve “at a non-linear rate,” strategists said the potential value could exceed even their optimistic estimates.

For investors, the message is clear: AI may become one of the largest wealth-creation engines in modern market history — but for workers, adaptation will be key.