In 2025, cryptocurrency trading is no longer about gut feelings or endless chart-watching. Artificial intelligence (AI) is leading a new era of trading, giving both retail and institutional investors access to insights that were once exclusive to hedge funds with large research teams.

From predicting market trends to automating complex strategies, AI-powered trading tools help traders maximize profits while reducing risk. Below, we explore the best AI crypto tools available in 2025 — and how you can combine them for a winning strategy.

What Are AI Crypto Trading Tools?

AI crypto tools use machine learning, predictive analytics, and natural language processing (NLP) to process massive datasets and deliver actionable trading insights.

They can help traders:

- Forecast price movements using historical and real-time data.

- Spot emerging narratives like AI tokens, DeFi growth, or Layer-2 adoption.

- Automate trades for faster, emotion-free execution.

- Manage risk with portfolio rebalancing and stop-loss recommendations.

In short, they turn raw crypto data into clear, data-driven decisions.

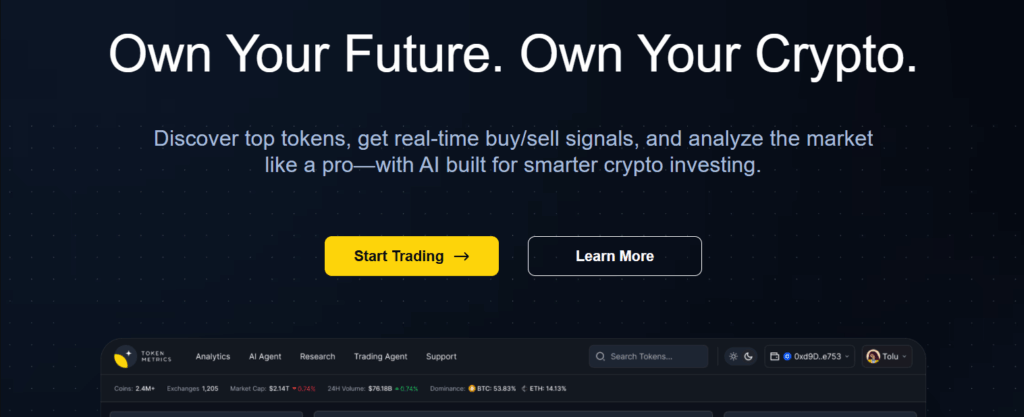

1. Token Metrics — All-in-One AI Intelligence Platform

Best for: Portfolio optimization, coin ratings, trend detection

Key Features:

- AI-powered ratings using 80+ data points per token.

- Early narrative detection (AI coins, RWA tokenization).

- Portfolio optimization aligned with personal goals.

- Real-time trading alerts and signals.

Why It Stands Out:

Token Metrics is more than a tool — it’s a complete trading intelligence system that helps traders uncover hidden gems and adjust strategies in volatile markets.

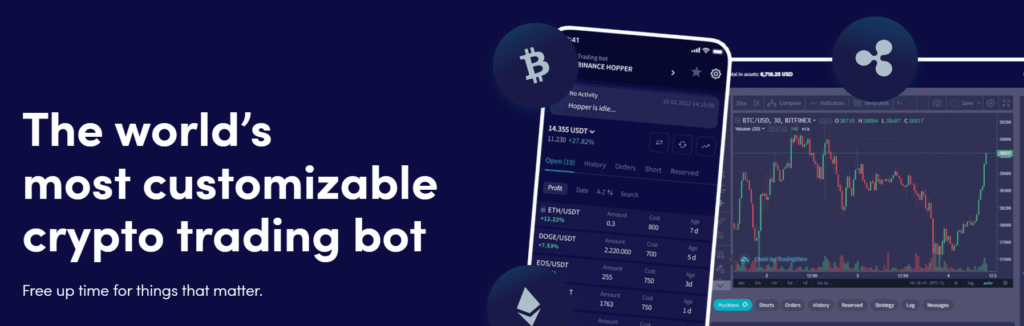

2. CryptoHopper — Automated AI Trading Bots

Best for: Hands-off trading automation

Key Features:

- AI bots adapt to real-time market conditions.

- Backtesting tools for validating strategies.

- Social trading to copy top traders’ moves.

Why It Stands Out:

Perfect for traders who want automation plus AI-driven insights, CryptoHopper executes trades on major exchanges without emotional bias.

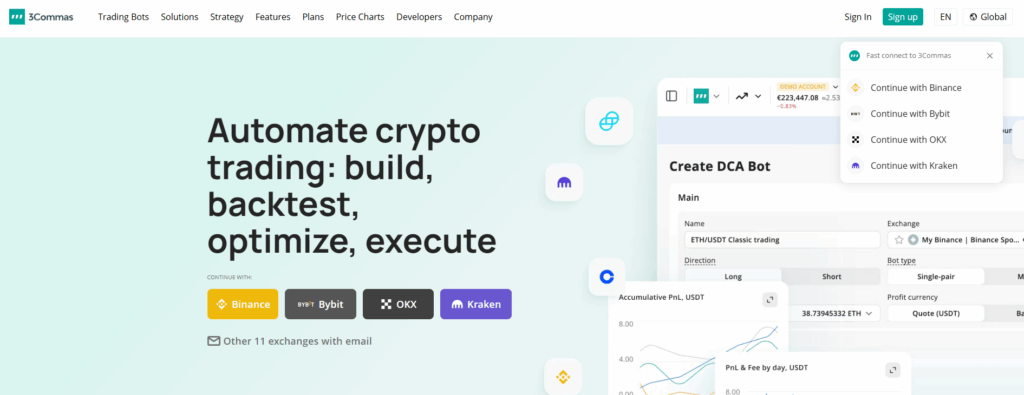

3. 3Commas — Portfolio and Trade Management with AI

Best for: Multi-exchange users and advanced traders

Key Features:

- AI portfolio rebalancing across different exchanges.

- Configurable trading bots for spot, futures, and options.

- SmartTrade terminal for precision order execution.

Why It Stands Out:

3Commas is ideal for active traders managing diverse portfolios, offering professional-grade AI analytics with flexibility.

4. Pionex — AI-Powered Grid & Arbitrage Trading

Best for: Profiting from volatility

Key Features:

- AI grid bots to automate buy-low/sell-high strategies.

- Arbitrage bots exploiting exchange price differences.

- Low trading fees for frequent use.

Why It Stands Out:

Pionex makes grid trading accessible to retail users, helping them earn in sideways markets without constant monitoring.

5. Numerai Signals — Crowdsourced AI Predictions

Best for: Data-driven, predictive trading

Key Features:

- Machine learning models from data scientists worldwide.

- Predictive trading signals using collective intelligence.

- Quantitative tools designed for institutional-level strategies.

Why It Stands Out:

Numerai’s unique crowdsourced approach delivers diverse and powerful trading insights not available elsewhere.

How to Choose the Right AI Trading Tool

When selecting a platform, consider:

- Your trading goals: Day trading, long-term investing, or portfolio building.

- Ease of use: Some platforms are beginner-friendly, others require advanced knowledge.

- Data sources: Ensure access to reliable, real-time market data.

- Integration: Check compatibility with your exchanges or wallets.

Combining AI Tools for Maximum Profits

The most successful traders combine multiple AI platforms:

- Use Token Metrics for early trend spotting and portfolio design.

- Automate trades with CryptoHopper or 3Commas.

- Deploy Pionex for volatility and arbitrage opportunities.

- Add Numerai for predictive insights.

This layered approach creates a comprehensive AI-powered strategy.

Risks of AI Trading Tools

AI is powerful, but not perfect. Risks include:

- Overreliance on bots: Systems can fail during extreme volatility.

- Data quality issues: Poor inputs lead to flawed predictions.

- Cybersecurity risks: Third-party tools require strong protection.

Pro tip: Token Metrics reduces these risks with transparent, multi-factor analysis before generating signals.

Conclusion

In 2025, AI is reshaping crypto trading by offering speed, accuracy, and insights that outperform manual strategies. Tools like Token Metrics, CryptoHopper, 3Commas, Pionex, and Numerai are helping traders stay ahead of the curve.

The future belongs to investors who leverage these platforms smartly, balancing automation with human judgment. With the right AI tools, information becomes power — and power becomes profit.