By 2025, AI-powered trading bots have moved from experimental tools to the frontline of crypto markets. No longer limited to simple automation, these bots use machine learning, reinforcement learning, and predictive analytics to adapt to live market conditions — offering speed and accuracy human traders can’t match.

But are these bots truly delivering an edge, or are they more hype than reality?

What Are AI Crypto Trading Bots?

Unlike traditional rule-based bots, AI crypto bots don’t just follow static triggers. Instead, they analyze thousands of data points, such as:

- Price trends and volatility cycles

- Trading volume shifts

- Sentiment from news and social media

- On-chain activity

- Macroeconomic signals

This makes them far more adaptive, self-improving, and disciplined compared to conventional bots.

AI Bots vs. Traditional Trading Bots

| Feature | Traditional Bot | AI Trading Bot |

|---|---|---|

| Rules | Static triggers | Adaptive, evolving |

| Data | Price + indicators | Price, volume, sentiment, macro data |

| Learning | None | Machine learning models |

| Strategy | Technical analysis only | Multi-variable decision-making |

| Optimization | Manual | Self-optimizing |

An AI bot can detect when a strategy starts failing and retrain itself to adjust, while traditional bots require manual reprogramming.

Spot vs. Futures AI Bots

- Spot Bots: Focus on trend detection, entry timing, and portfolio rebalancing. Often leverage sentiment analysis for long-term positioning.

- Futures Bots: Built for speed. Handle leverage, liquidation avoidance, and arbitrage across pairs or exchanges. High-frequency strategies emphasize both profit generation and risk control.

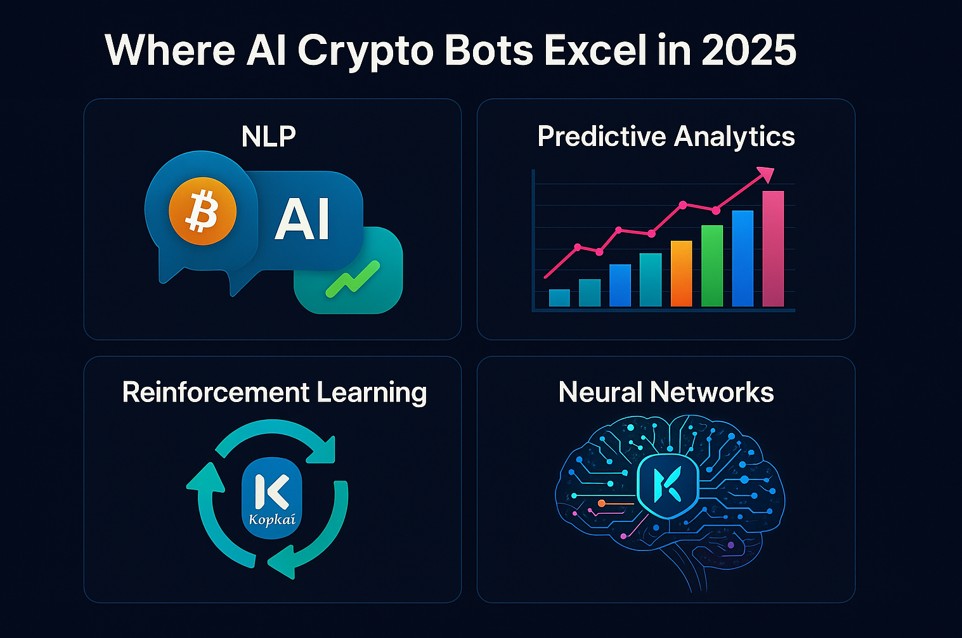

Key AI Tools Powering Crypto Bots in 2025

- NLP Engines: Analyze news, Reddit, and X for sentiment.

- Predictive Analytics: Forecast prices using historical data.

- Reinforcement Learning: Adjust strategies in real time.

- Neural Networks: Detect non-linear patterns in complex markets.

Frameworks like TensorFlow and Scikit-learn are popular, while platforms like Bitunix integrate AI models with low-latency APIs for execution.

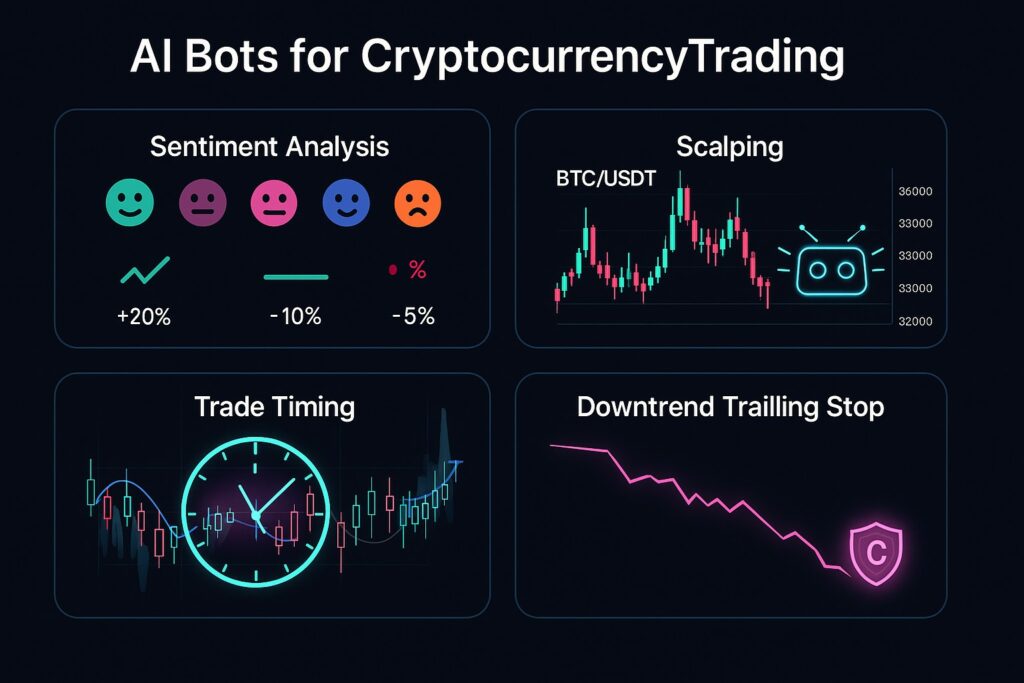

Where AI Bots Excel

- Sentiment Processing: Gauge social mood and adjust trades quickly.

- Scalping Micro-Trades: Identify millisecond opportunities humans miss.

- Trade Timing Optimization: Avoid “liquidity traps” by reading intraday cycles.

- Capital Protection: Trailing stop-losses adapt during downtrends.

Challenges and Risks

- Overfitting: Bots trained on past data may fail in new conditions.

- Data Bias: Sarcasm or slang in sentiment models can cause misreads.

- Latency: Slow connections can ruin high-frequency strategies.

- Security Risks: Poor API key management can lead to fund theft.

How to Choose the Right AI Trading Bot

When evaluating bots, consider:

- Transparency: Is it a black box or does it show strategy logic?

- Performance Metrics: Sharpe ratio, win/loss, drawdown, and updated backtests.

- Exchange Compatibility: Ensure stable API connections (Bitunix offers advanced endpoints).

- Customizability: Ability to set risk caps, stop-losses, leverage, and trading pairs.

Case Study: BTC Futures Scalping Bot

- Asset: BTC/USDT perpetuals

- Strategy: Momentum scalping (5-minute chart)

- Tools: MACD, RSI, sentiment scores from Twitter

- Risk: 2% cap per position, leverage up to 10x

- Results (30 days):

- Win rate: 62%

- Max drawdown: 5.3%

- ROI: 18.4%

While it struggled in sideways conditions, the bot adapted automatically by switching strategies — highlighting why AI bots are gaining favor among traders.

FAQ

Are AI bots better than manual trading?

They offer speed and consistency but work best with manual oversight.

Do I need coding skills?

Not always. Some platforms are plug-and-play; others need Python/JavaScript integration.

Are they legal?

Yes, provided they comply with exchange rules.

Can they trade altcoins?

Yes. Many bots support altcoin trading with liquidity checks and sentiment monitoring.

Bottom Line

AI crypto bots in 2025 are more than hype — they’re a genuine competitive edge when used correctly. While not foolproof, their ability to adapt, analyze sentiment, and execute with precision gives traders an advantage in volatile markets.

The key is pairing AI automation with human judgment, strong risk management, and secure platforms.